High Val, Quick Close, Great Firm (Pick 2) + Fundraising Fieldnotes - 7.23.21

The Fundraising Trilemma - learn about it...

Hey - it’s Jason Yeh 🕺🏻

This is my Friday recap of thoughts I’ve had while helping founders solve their fundraising challenges this past week (7.23.21)

If you have any questions, please reply! I try to get to every comment/question I get :)

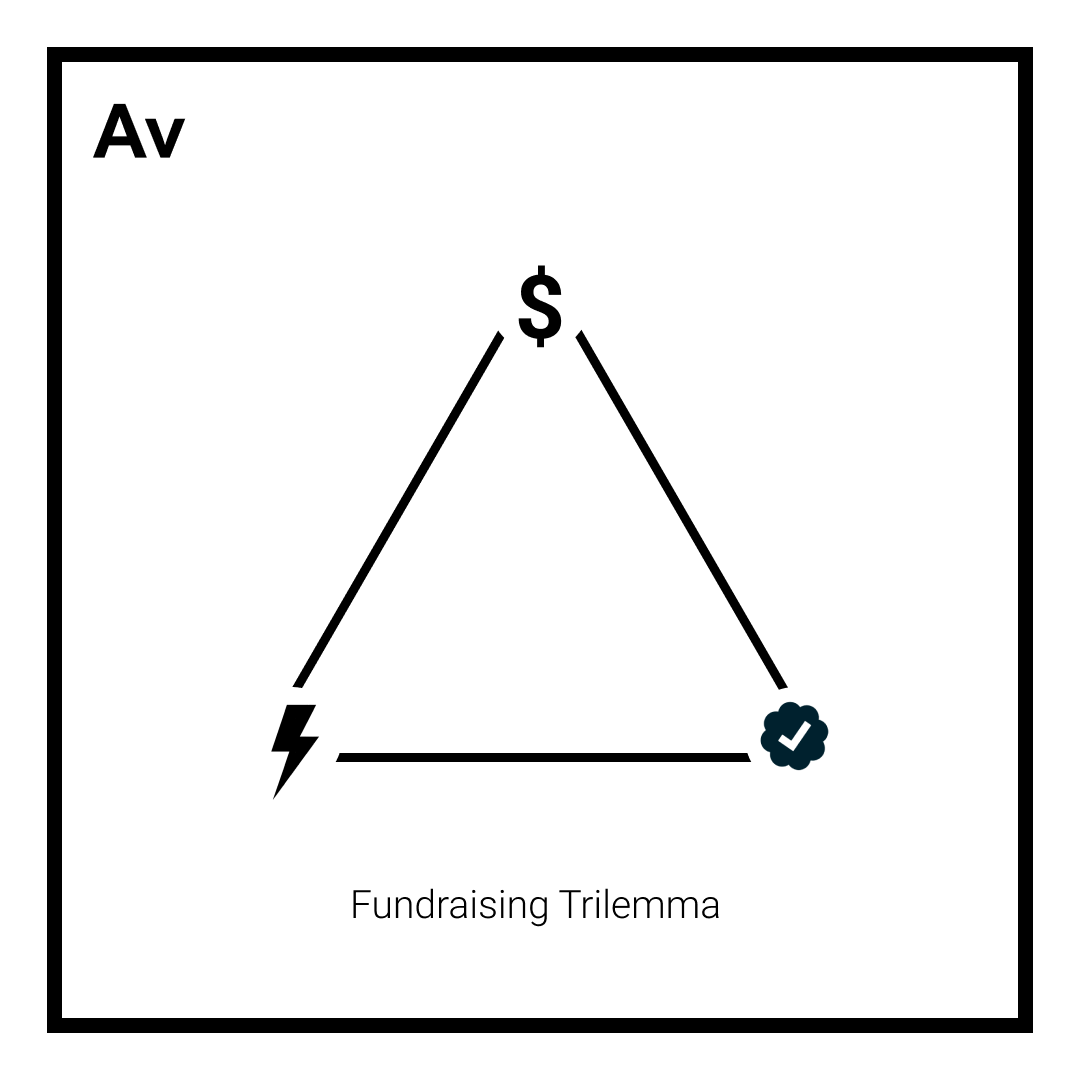

The Fundraising Trilemma - High Val, Quick Close, Great Firm (Pick 2)

In economic theory, the trilemma refers to the challenge countries face of only being able to choose 2 of 3 elements when creating their international monetary policy. It was a favorite topic of mine from business school (nerd alert I know) so I couldn’t help but think about it when I saw this tweet from David Frankel:

It may seem like a simple concept, but it’s worth breaking down as a teaching concept in fundraising. Really understanding why David believes that you can only choose two (and I do too) is a window into more deeply understanding investor psychology. And, once you understand investor psychology, you have all you need to creatively problem solve when fundraising (as opposed to blindly following expert opinion on Twitter).

Let’s start with the founder’s POV

Looking at the 3 elements of high valuation, quick close, and great firm, a founder would love to have all 3 in a fundraise. A high valuation minimizes dilution, a quick close removes stress / distraction, and a great firm better supports the company (oversimplifications I know).

From the investor’s side...

The two elements that they can control in a live deal, quick close and high valuation, both represent things they don’t necessarily want to give. A quick close means less time for diligence, and high valuation depresses returns.

For any deal worth doing, 1 of the 3 alone will not be enough to get a deal done so we need to look at the situation for each 2-element combination.

Quick Close + High Valuation

This situation is a firm whose reputation isn’t a huge positive on its own... (continue reading for the rest…)

On to the Fieldnotes for 7.23.21…

You want me to cut out more? I can’t cut that out of the pitch! 💇🏻♂️😳

I did run into this from a founder this week, but I could probably include a similar quote in every week’s Fieldnotes. It’s that common.

When I work with founders on their narrative and pitch deck, I’m almost always deleting more than I’m adding. There is so much addition by subtraction when it comes to a fundraising narrative. I think the main things that are difficult for founders to grasp are:

The initial pitch + deck does not close funding on its own. It’s there to get an investor interested in digging further. Anything more will likely just confuse and cloud the story.

Not only do you need to catch an investor’s attention quickly, they also have to be able to easily repeat your pitch back to their partners. That doesn’t happen with a super complex story.

Cutting stuff out feels like it’s minimizing all the work that has gone into building the company up to this point. Taking things out of something that’s supposed to represent your baby feels like cutting off an arm and a toe. It’s painful for founders.

And because of all that, I get HUGE pushback from founders when I tell them to reduce reduce reduce.

Protip: when actually acting on the advice to change or reduce, it can be helpful to start from scratch. Many times there’s too much attachment to the content that was already produced.

Till next week. Stay adamant and be chased.

Jason

p.s. Have you listened to this trailer?? Season 2 of Funded comes out this Tuesday July 27!

BIG ask!

If you get value from this newsletter, I’d love if you subscribed to the Funded podcast. It’ll help you know when episodes drop and the algorithms love it.

BONUS points if you leave a 5⭐️ rating and review -> https://podcasts.apple.com/us/podcast/funded-how-they-raised-millions/id1535885510