1st Time Founders Are Terrible… Do Accelerators Help?

While finishing this essay, I posted one sentence from my writing (out of context) on Twitter. It was polarizing...

I was tempted to modify the whole essay to focus on this concept, but I’ll save that for another time…

Surprise. This essay is about Accelerators 🤷🏻

You might not want to join an accelerator, but that’s fine. But keep reading to learn why they’re valuable so you can DIY the experience…

I think many accelerator programs are super valuable. That wasn’t always my opinion.

In 2017, when I was starting my last company, Tape, many people close to the Y Combinator organization recommended we apply. The insinuation was that we’d be a shoo-in.

This picture was taken in month three of my startup, Tape.

At the time, I looked at YC and most other accelerators through one lens only - fundraising. A program that would help you get funding and, in YC’s special case, financing at a higher valuation. With my inflated sense of self as a founder, all other aspects of their support were useless.

I did some quick calculations on the YC valuation lift and quickly determined that YC wasn’t worth it for me. I was great at fundraising and would have no problems closing capital. The 7% added dilution for a little valuation bump and operational support I didn’t think needed was too rich for my blood.

Since then, many of my worldviews have changed. Here are a few recent updates:

First, while I still think I’m very capable… that sense of self is far less inflated. I know I still have a lot to learn slash will always have a lot to learn.

Second, I used to hate Lebron James. Today, I have to admit… Lebron is amazing.

Third, the right accelerator can be extremely valuable for many founders.

How do Accelerators help?

If you consider joining an accelerator program, the right ones can deliver significant value for founders in the following categories.

Execution

Network & Credibility

Fundraising

Execution

I completely overlooked a big portion of YC's value because of an inflated sense of self. I hadn’t gone through the startup ringer yet, so I believed I could do it all alone.

*The truth is, first-time founders are TERRIBLE.

The ones that succeed find ways to improve quickly.

The value of YC and other well-established accelerator programs is providing founders with education, infrastructure, and accountability to help establish early momentum in execution. This momentum drives rapid improvement in founders. YC, in particular, is well known for setting aggressive growth targets for their companies during the program, supported by top-level mentorship and reinforced by social accountability.

Could you do that on your own?

Sure. The Internet is a free school; technically, you could set accountability targets and hold yourself to them. This is possible. Especially if you have experience and a full team around you. But if you’re light on team and experience, this element of accelerator programs is extremely valuable.

*Sadly, I was not an exception to this rule. I, too, was terrible. Even worse, I didn’t realize it.

Network & Credibility

The quick injection of network and borrowed credibility that an accelerator program provides is a big part of the pitch to join. Because these programs have some level of filtering via applications and interviews, just being part of the program sends a signal to the market. “Someone else said this company is cool!”

This signal strengthens as more successful companies pass through the program. Eventually, the message becomes, “The same group that said Stripe was cool has also said this company is cool!”

Every program member has this same credibility boost, so there is a multiplier effect on the value of the network you join.

The credentials of being a YC founder, an On Deck or Latitud fellow, a graduate of TechStars, etc. help a ton with BD, recruiting, and…recruiting (see point 3).

Those who are newcomers to the industry, outside the inner circles within Silicon Valley, or lacking resume logos may find it challenging to jumpstart this credential and network on their own.

Lastly, fundraising.

Many accelerator programs conclude their programs with a demo day.

Demo Days help set up many of the dynamics I coach in an effective fundraiser that are TONS of work to do on your own.

If you’re on your own, even establishing a date when you’ll start fundraising is hard. Even harder is getting yourself to prepare for that. But with a Demo Day deadline PLUS mentors pushing you to organize, founders get to avoid the procrastination trap that can plague many founders.

If you’re alone, you’ll need to find investors to target and identify connectors to make warm introductions. This effort takes weeks, requiring you to scour lists online, comb through LinkedIn, and send hundreds of emails… An accelerator completely bypasses this exhaustive process. The program provides a list of investors to connect with and does the warm intros for you by inviting VCs to the Demo Day.

And the piece de resistance…if you’re on your own, I highly recommend you pursue calendar density during your fundraising process. This strategy is designed to create the optimal circumstances for a deal to get done. There is significant work lining this up on your own: organizing intros appropriately, project managing everyone, scheduling meetings, etc. On the other hand, an accelerator program’s Demo Day is Calendar Density in a can! First meetings with Calendar Density usually happen over two weeks. At YC’s demo day, around 400 founders essentially do their first meetings with 1,500 investors on the same day (all at once). Calendar Density to the nth degree! With that, every investor attending Demo Day realizes they’re not the only game in town, and the pressure is on.

Parting thoughts

What’s my main takeaway? Along the path towards success (in your company or life), realize there’s no prize for doing it alone. The best in the world have helped along the way, and it does take a village.

Find out what the best help is for you, and get it.

PS I have no affiliation with any of the accelerators above, especially not YC! I’ve even been known to speak poorly about YC’s standard post-money SAFE). I was inspired to write about accelerators after giving the same advice to another founder this past week.

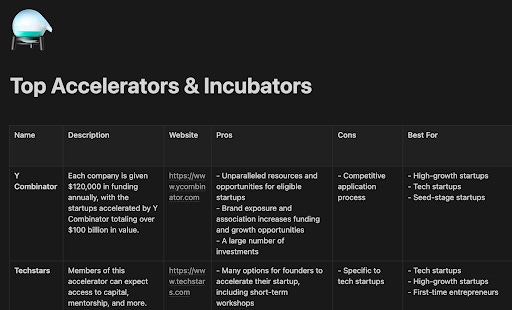

PPS If you are interested in browsing some of the world's top accelerator/incubator programs, we pulled together a list from various sources on the interwebs. We plopped it in a convenient Notion doc here. What can I say? I’m a happy #notionpartner:

https://adamant.notion.site/Top-Accelerators-Incubators-de10ef7348ba4d7dab091d8f5cc59bc9

Don’t forget: readers of Fundraising Fieldnotes can apply to get up to $1000 of credit on Notion using this link -> https://ntn.so/adamant

Hungry for more fundraising guidance?

→ Access our exclusive rewards for Fundraising Fieldnotes subscribers.

Subscribe here, and you’ll be enrolled in our referral program, exclusively for Fundraising Fieldnotes readers: https://bit.ly/FundraisingFieldnotesLI

→ Planning to raise a round in 3–6 months? Join Fundraise with Confidence: https://www.fundraisewithconfidence.com/

→ Follow me on Twitter: https://twitter.com/jayyeh

→ Listen with a friend to Funded, my podcast that tells the rollercoaster stories of how founders raised millions — (please leave a rating and subscribe): https://www.fundedpod.com/